Find Cashback Businesses & Cash Services Near You

Discover local stores offering cashback on purchases, find ATMs, and connect with cash services in your city.

What is Cashtic?

Mission

Cashtic connects people through a peer-powered cash exchange network—enabling access, flexibility, and grassroots financial participation. Users remain in control of who they meet and how they interact.

⚖️ Legal Disclaimer

⚠️ Cashtic is a peer-based platform. We do not screen users or supervise transactions. Always meet safely and only with people you trust. You are solely responsible for your interactions.

How we hope it will work for you

Here is how we're hoping Cashtic will work for you, but results may vary:

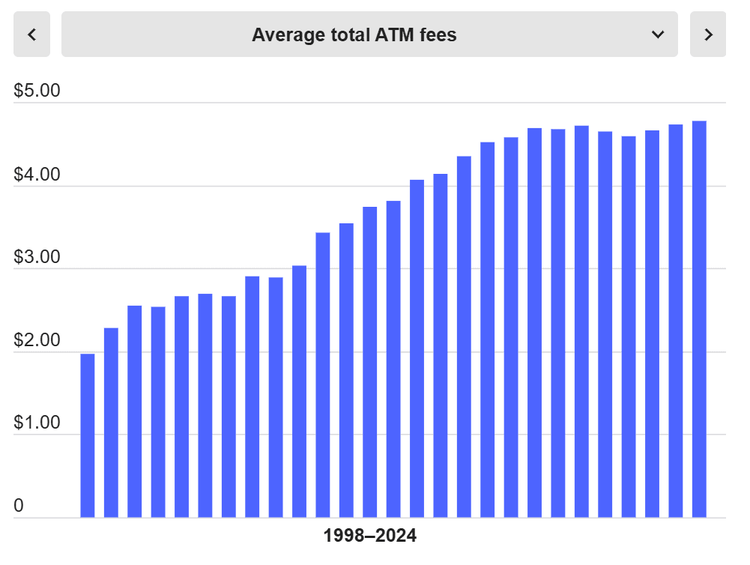

💸 Need Cash? Ditch the ATM hassle

Cashtic helps you connect with nearby people (if any) who are willing to hand you cash in exchange for a digital payment. It's peer-to-peer, location-based, and totally in your hands.

🛠️ Here's the idea:

📍 Make a request

Enter the amount, time, and a safe meetup location—like a well-lit café or a police station.

👀 Wait for a match

If someone nearby can help, they'll send you an offer. No one around yet? Don't bail—we'll keep your request and ping you if someone pops up.

🤝 Pick your person

Got options? Choose the user you vibe with. Cashtic doesn't perform background checks—so it's up to you to verify identity and meet responsibly.

📦 Meet up & trade

Chat through the app, meet in a safe spot, and swap cash like civilized humans.

💳 Pay it back

Send the money (plus any agreed tip) through your favorite transfer app—bank, Revolut, PayPal. Cashtic doesn't touch your money—we just make the intro.

What We Offer

Location-Based Search

Find cash services, cashback businesses, and ATMs in any city worldwide using our comprehensive location database.

Cashback Business Directory

Browse local cashback businesses offering cash services, money transfers, and financial solutions.

User Community

Connect with other users offering or seeking cash services in your area.

ATM Locator

Find the nearest ATMs with real-time availability and service information.

List Your Cashback Business

Are you a cashback provider, money changer, or financial service business? Join the Cashtic directory and get discovered by people actively searching for cash services near them.

Peer-to-Peer Safety & Trust

Your safety is our top priority. Since Cashtic is a peer-to-peer network, we've built-in features and guidelines to help you trade with confidence.

Public Meetups

Always choose well-lit, busy public locations like cafés, malls, or police stations for your exchanges.

Verify Identity

Check the other user's profile and ratings before meeting. Don't hesitate to ask for a quick ID verification.

Secure Payments

Use trusted digital payment apps for the transfer. Cashtic never stores your financial information.

Community Rated

Our rating system helps you identify reliable peers who have successfully completed exchanges before.

Top Countries by User Count

| # | Country | Active Users | Action |

|---|---|---|---|

| 4 |

Nigeria

NG

|

639 Users

|

Details |

| 5 |

Tanzania

TZ

|

346 Users

|

Details |

| 6 |

India

IN

|

318 Users

|

Details |

| 7 |

Pakistan

PK

|

266 Users

|

Details |

| 8 |

South Africa

ZA

|

199 Users

|

Details |

| 9 |

Egypt

EG

|

159 Users

|

Details |

| 10 |

Indonesia

ID

|

153 Users

|

Details |

| 11 |

Philippines

PH

|

115 Users

|

Details |

| 12 |

Malaysia

MY

|

102 Users

|

Details |

Top Cities by User Count

| # | City | Active Users | Action |

|---|---|---|---|

| 4 |

491 Users

|

Details | |

| 5 |

440 Users

|

Details | |

| 6 |

333 Users

|

Details | |

| 7 |

326 Users

|

Details | |

| 8 |

312 Users

|

Details | |

| 9 |

292 Users

|

Details | |

| 10 |

286 Users

|

Details | |

| 11 |

262 Users

|

Details | |

| 12 |

260 Users

|

Details |

Top Cities by ATM Count

Cities with the most ATMs mapped worldwide — find cash wherever you travel.

Frequently Asked Questions

What is Cashtic?

Cashtic is a peer-to-peer cash exchange network that connects people who need cash with those who have it. It's an alternative to traditional ATMs, allowing users to exchange digital payments for physical cash through safe, local meetups.

How does Cashtic work?

Users create requests specifying the amount of cash needed, preferred meetup location, and time. Other users nearby can accept the request. Both parties meet at a safe, public location to exchange cash for a digital payment (via Venmo, PayPal, Zelle, etc.).

Is Cashtic safe?

Cashtic is a peer-based platform. We recommend always meeting in well-lit, public places like cafés, police stations, or busy shopping centers. You are solely responsible for your interactions and should only meet with people you trust.

How much does Cashtic cost?

Cashtic is free to use. There are no subscription fees or transaction fees charged by Cashtic. However, your chosen digital payment method (Venmo, PayPal, etc.) may have its own fees.

Where is Cashtic available?

Cashtic is available worldwide in over 228,000 cities across multiple countries. Our largest user bases are in the United States, India, China, Indonesia, Pakistan, and Nigeria.

Can I find ATMs on Cashtic?

Yes! In addition to peer-to-peer cash exchange, Cashtic also provides a comprehensive ATM locator with over 377,000 ATMs worldwide. You can search for nearby ATMs by city or location.