The Cashtic Opportunity: Escape the ATM Fee Trap

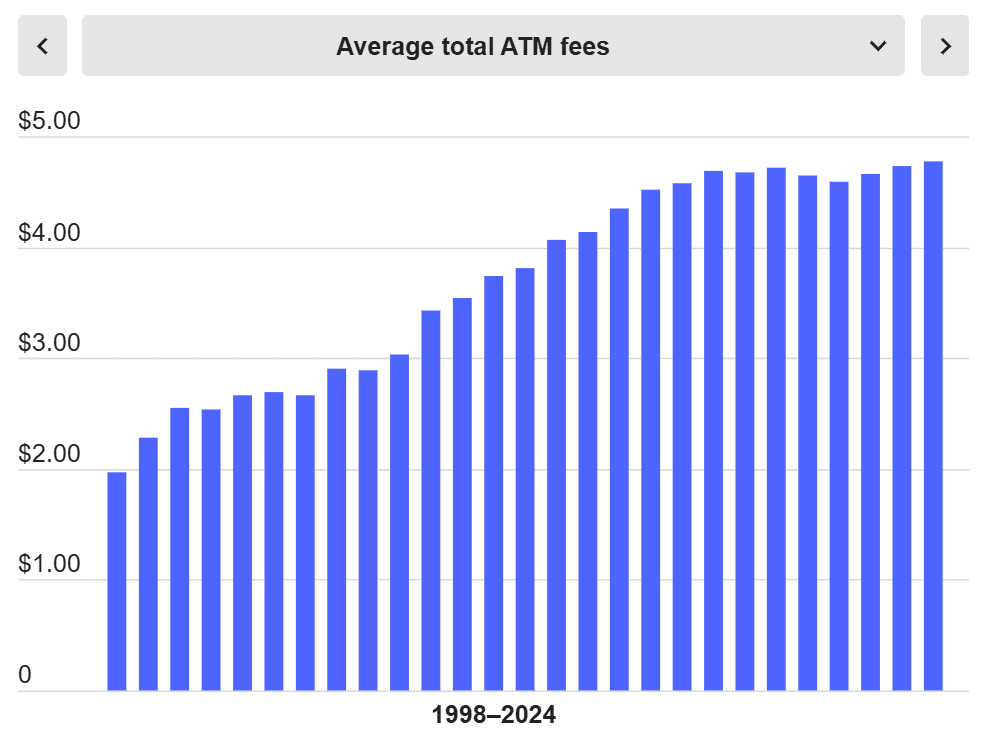

In a world where accessing your own money has become an expensive ordeal, Cashtic Peer ATM Network emerges as the revolutionary answer to a financial dilemma that's been quietly draining wallets for over two decades. According to Bankrate’s 2024 Checking Account and ATM Fee Study, the average out-of-network ATM withdrawal fee has skyrocketed to an all-time high of $4.77—a staggering leap since records began in 1998. In cities like Atlanta, fees are topping $5.33 per transaction. The message is clear: your cash is under siege.

The ATM Fee Crisis

Imagine paying over $60 a year just to access your own money, assuming you withdraw cash once a week. Multiply that across millions of people, and we're looking at billions siphoned away in fees—fees that benefit no one except banks and ATM operators. These costs aren’t just a nuisance; they’re an economic inefficiency begging for disruption.

And while traditional banks advise you to "stick to in-network ATMs" or "set up direct deposits" to dodge these charges, what happens when you're traveling, in an emergency, or simply nowhere near your bank's limited network?

Enter Cashtic: Your Money, Your Terms

Cashtic Peer ATM Network flips the script. Why hunt for an ATM when there are people around you with cash? With Cashtic, you can request cash from nearby users securely and efficiently—often without the sky-high fees that banks demand. It’s peer-to-peer, immediate, and designed for the modern world where convenience and cost-savings go hand in hand.

Why Cashtic Is the Future of Cash Access:

- Dodge Outrageous ATM Fees: No more paying $5 to withdraw $20. With Cashtic, fees are transparent and often significantly lower.

- Faster Than an ATM: Request cash, get notified, meet a verified Cashtic user, and you’re done. No lines, no broken machines.

- Secure and Trusted: Our app ensures both parties are verified, and transactions are tracked for safety.

- Community-Powered: Turn your own cash into a resource. Provide cash to others and earn small fees, making your money work even harder.

The Economic Shift Is Here

As overdraft fees creep back up to $27.08 on average and banks demand record-high minimum balances to avoid service fees ($10,210, according to Bankrate), Cashtic represents not just an app, but a financial movement. It’s about reclaiming control from institutions that profit from your inconvenience.

So, the next time you find yourself facing a $5 ATM surcharge, remember: there’s a Cashtic user nearby, ready to help you out—without the sting of hidden fees.

Join the Cashtic revolution. Your wallet will thank you.

Source of ATM fee study: Bennett, K., & Goldberg, M. (2024, August 21). Survey: ATM fees reach 26-year high while overdraft fees inch back up. Bankrate. Retrieved February 04, 2025, from https://www.bankrate.com/banking/checking/checking-account-survey/