Cash Comeback: A Decade-High Surge as Britons Battle Soaring Prices!

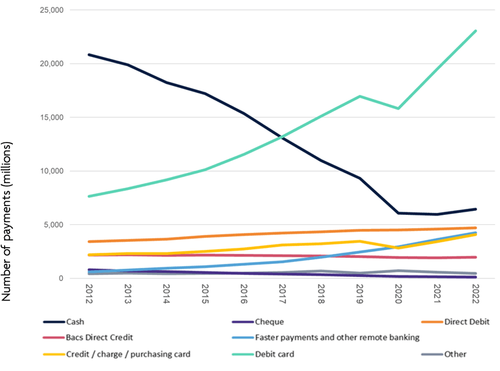

In a stunning twist, cash payments surged for the first time in ten years as Britons grappled with skyrocketing costs. Yet, the mighty debit card reigns supreme, commanding half of all transactions and hitting a record high.

As wallets tighten, cash is crowned the people's choice for budgeting. UK Finance reveals a fascinating shift: while nearly 22 million people sparingly touched cash, less than a million swore by it. Debit cards, beloved for their contactless convenience, saw a monumental rise, fueled by the new hybrid work era and a sharp decline in season ticket sales.

Intriguingly, low-cost grocery runs and frequent, small supermarket visits emerged as the savvy shopper's strategy to combat inflation. This budget-savvy behavior sparked a 7% increase in cash payments from 2021, positioning it as the second most popular payment method, albeit at a modest 14% of total transactions.

Source: https://www.ukfinance.org.uk/news-and-insight/press-release/half-all-payments-now-made-using-debit-cards

Cheques, meanwhile, teeter on the brink of extinction, with the average Brit writing less than one every two years. Yet, a fierce campaign to preserve cash access for all led to the Treasury's landmark decision: banks now face fines if they fail to provide free cash withdrawals within a mile in urban areas or three miles in rural zones.

Amid economic challenges, Graham Mott of Link, which oversees the UK’s cash machine network, champions the enduring need for cash. "We're ensuring every high street has free cash access. Where the last machine closes, we replace it," he asserts.

The Post Office reports a record-breaking wave of cash transactions, with counters buzzing in areas abandoned by bank closures. As the cost-of-living crisis deepens, the resurgence of cash is a powerful testament to the resilience and adaptability of the British public.