💰Cash will be King forever👑 - an analysis of cash usage statistics in the USA, EU, India, and China

In an era where digital transactions and emerging cryptocurrencies appear to dominate, the ongoing debate about the relevance of physical cash in the global economy has gained significant traction. This article delves into data from the four largest economies - the United States, the European Union, China, and India - to explore the enduring role of cash in their financial systems. Despite the advancements in digital payment technologies, cash continues to maintain its significance for a multitude of reasons, ranging from cultural norms to practical accessibility.

The United States

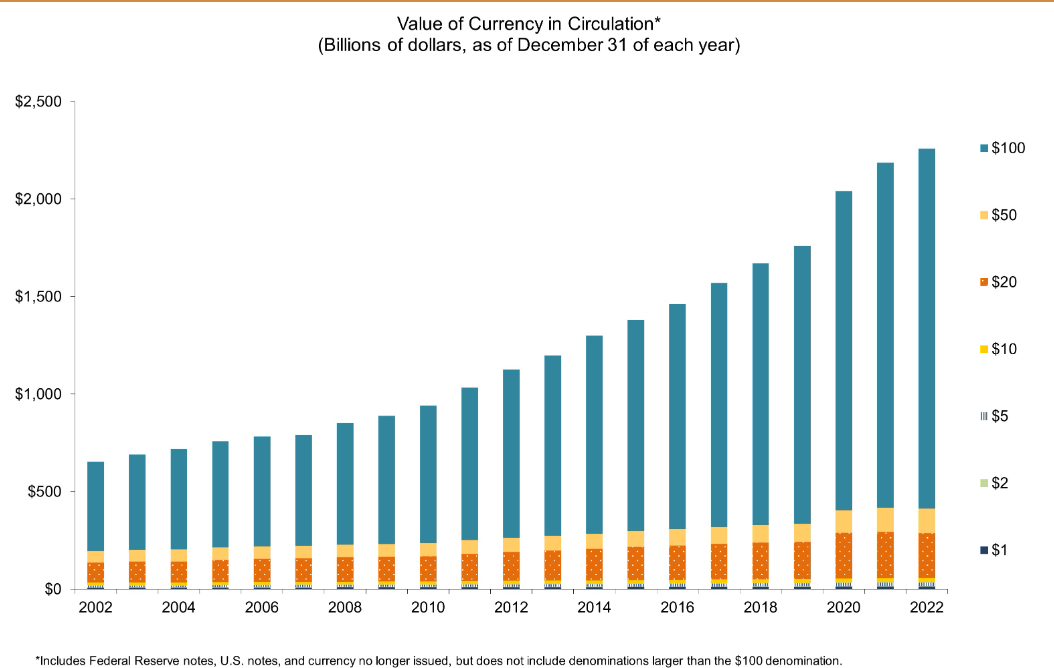

The United States, a global technological leader, demonstrates a noteworthy example of how cash remains integral to the modern economy. While digital payment methods have gained substantial ground, physical currency is still widely used. According to the Federal Reserve's 2023 report on the Diary of Consumer Payment Choice, since the pandemic "aggregate demand for cash continued to increase. As of October 2022, the value of currency in circulation passed $2.23 trillion, a 28 percent increase compared to February 2020". This statistic underscores the tangible presence of cash in everyday economic interactions.

Just look at the consistent growth of cash in circulation as per the Federal Reserve's currency in circulation chart:

https://www.federalreserve.gov/paymentsystems/coin_data.htm

The American attachment to cash is influenced by cultural factors, as many citizens perceive it as a symbol of tangible wealth and a safeguard during periods of economic uncertainty. Furthermore, cash caters to demographics without easy access to banking services or advanced digital technology.

The European Union

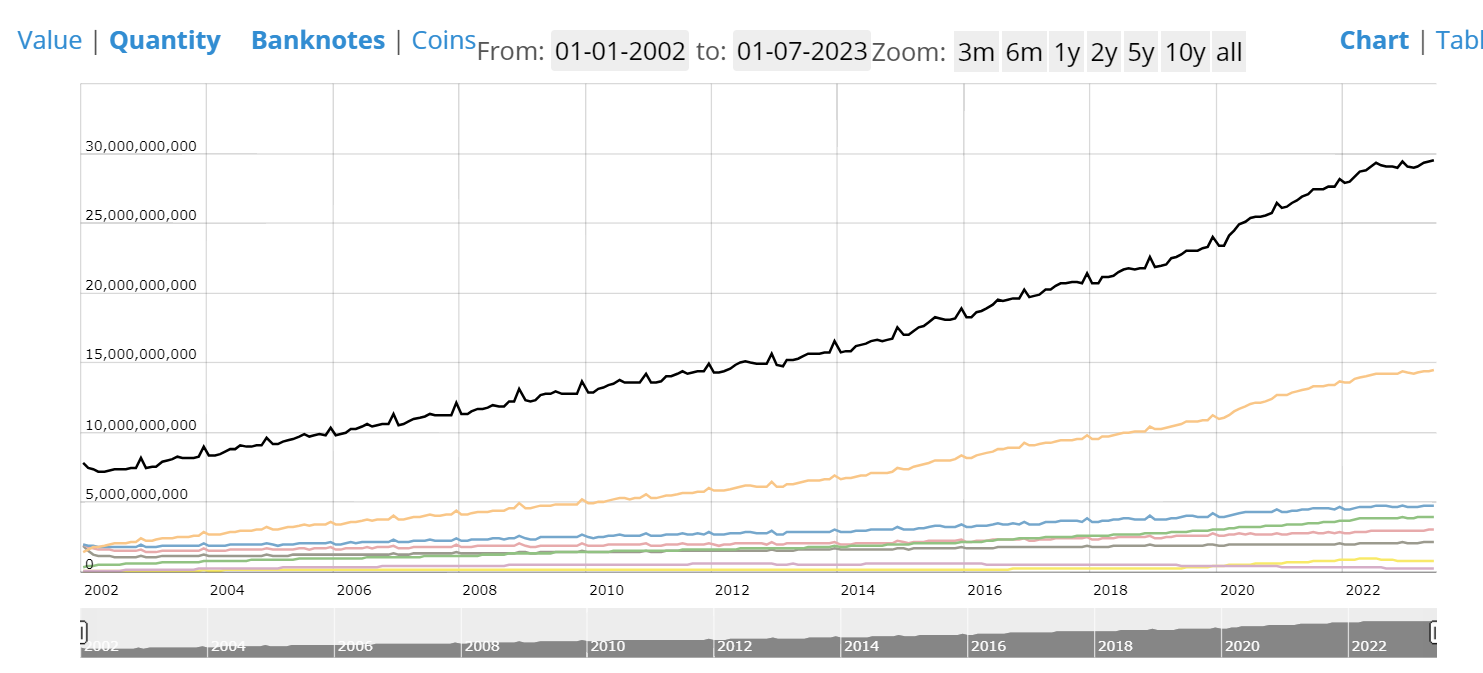

The European Central Bank's latest data post titled "Cash or cashless, how people pay" reveals that "cash remains the most frequently used means of payment. More than half of all day-to-day transactions in shops, restaurants, etc. are made using coins and banknotes." Just look at the ECB's chart on EU currency in circulation showing a similar growing trend:

China

China's rapid transition into a digital payment powerhouse is globally recognized, with platforms like Alipay and WeChat Pay revolutionizing the payment landscape. However, even amid this transformation, cash remains a significant player. The People's Bank of China reported that demand for notes and coins has remained brisk in China. The country's cash in circulation came in at 9.08 trillion yuan ($1.43 trillion) as at the end of 2021, notching up a steady growth of 7.7 percent year-on-year. Also, a net of 651 billion yuan in cash was released into society in 2021, said the People's Bank of China, the country's central bank. China's dual payment system, comprising digital platforms and cash, reflects its diverse economic landscape. While urban centers enthusiastically embrace digital payments, rural areas and smaller businesses heavily rely on cash. Additionally, cash acts as a reliable fallback during emergencies, natural disasters, or technology disruptions.

India

Adding India to the discussion sheds light on how cash remains king in diverse economic contexts. India's economy, though witnessing digital advancements, still relies substantially on cash. According to the 2023 annual report by the Reserve Bank of India, "the value and volume of banknotes in circulation increased by 7.8 per cent and 4.4 per cent, respectively, during 2022-23 as compared with 9.9 per cent and 5.0 per cent, respectively, during 2021-22" In India, cash transcends its transactional role; it is deeply woven into the cultural fabric. Rural communities, where cash is essential for daily transactions, play a vital role in sustaining the demand for physical currency. Moreover, the Indian government's push towards financial inclusion through schemes like Jan Dhan Yojana ensures that cash remains a cornerstone of economic activities.

Conclusion

The exploration of four of the largest economies - the United States, the European Union, China, and India - underscores a resounding truth: cash's reign is far from over. The coexistence of digital payments and physical currency in these diverse contexts emphasizes the multifaceted role that cash plays. Whether as a symbol of wealth, a tool for privacy, or a lifeline during crises, cash continues to be a dominant force in the global financial landscape. As the world evolves, the endurance of cash reminds us that it's not just about convenience; it's about maintaining economic stability, inclusivity, and the preservation of financial choices for all. If you need cash right now, try Cashtic which tries to be a Peer ATM Mobile Network, where users can request and give cash to each other, ensuring sufficient cash liquidity in every corner of the globe